[Business] Part 2: Finding the Perfect Investment for 2025

Part 2: Assessing the Macro Environment

Kon’nichiwa Readers,

In Part 1 of this mini-series, ‘Finding the Perfect Investment for 2025’ I covered:

Investment Goals

Assessing my Intuition

Screening for Investment Opportunities

I went a little deeper to explain what my investment goals were and how that translated into the type of opportunities I was looking for, laid out my personal intuition on how the markets are doing and flowing, and introduced how I screened U.S. equities for an initial set of investment opportunities.

In this post, I’m going to delve a bit further to gain a quantitative understanding of important contextual macro factors that play into every investment. Specifically, I’m going to go through:

Assessing the Macro Environment

(Part 3 Preview) Assessing the Industry Environment

(Part 3 Preview) Understanding Industry Metrics

(Part 3 Preview) Screening, Screening, and More Screening

The Macro Environment is a behemoth of a topic. Let’s get into it 🔥 ⬇️

4. Assessing the Macro Environment

Okay, now let’s take a look at the actual numbers. Earlier I expressed my intuitions on the market, and this section is to rule out some of those intuitions, back them up, and also recognize that some intuitions will remain vibe-based, and that’s okay for me!

Specifically, I think it’s important to look at:

A. Interest Rates

B. Government Debt

C. Market & Industry Performance

D. Consumer Sentiment

E. Policy Risk

“My message to every business in the world is very simple: Come make your product in America, and we will give you among the lowest taxes of any nation on Earth.”

[…]

“But if you don’t make your product in America, which is your prerogative, then, very simply, you will have to pay a tariff — differing amounts, but a tariff — which will direct hundreds of billions of dollars and even trillions of dollars into our Treasury to strengthen our economy and pay down debt.”

From President Donald Trump @ World Economic Forum

A. Interest Rates

At the time of this writing, the fed funds rate is 4.25-4.5% — down nearly 1% from this summer, another .5% from this fall.

This rate isn’t necessarily good or bad, but one thing that I’m confident in is the Fed’s current attitude towards inflation — they aren’t going to let it slip. So, for me, I think my view on the fed funds rate is that it is keeping inflation low and that’s really what I’m going to watch more than anything.

B. Government Debt

Looking long term, treasury bonds have a healthy looking yield curve.

In general, we’ve seen a pretty consistent amount of government debt being issued over the past year. This is important as it doesn’t seem like the treasury is trying to undermine anything going on with the Fed setting interest rates to combat inflation.

Overall, I see an economy with a great short term outlook (1 year) from a fundamentals perspective — which is really what I’m focusing on for this investment.

C. Market & Industry Performance

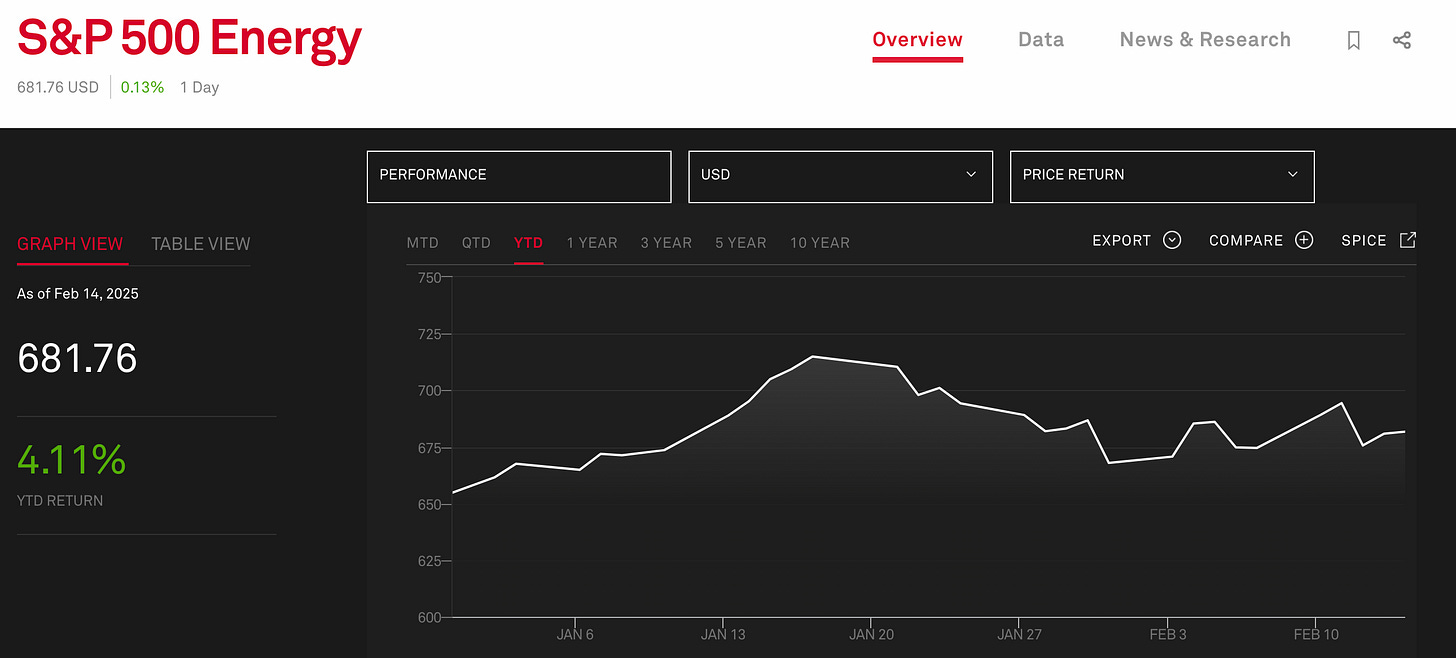

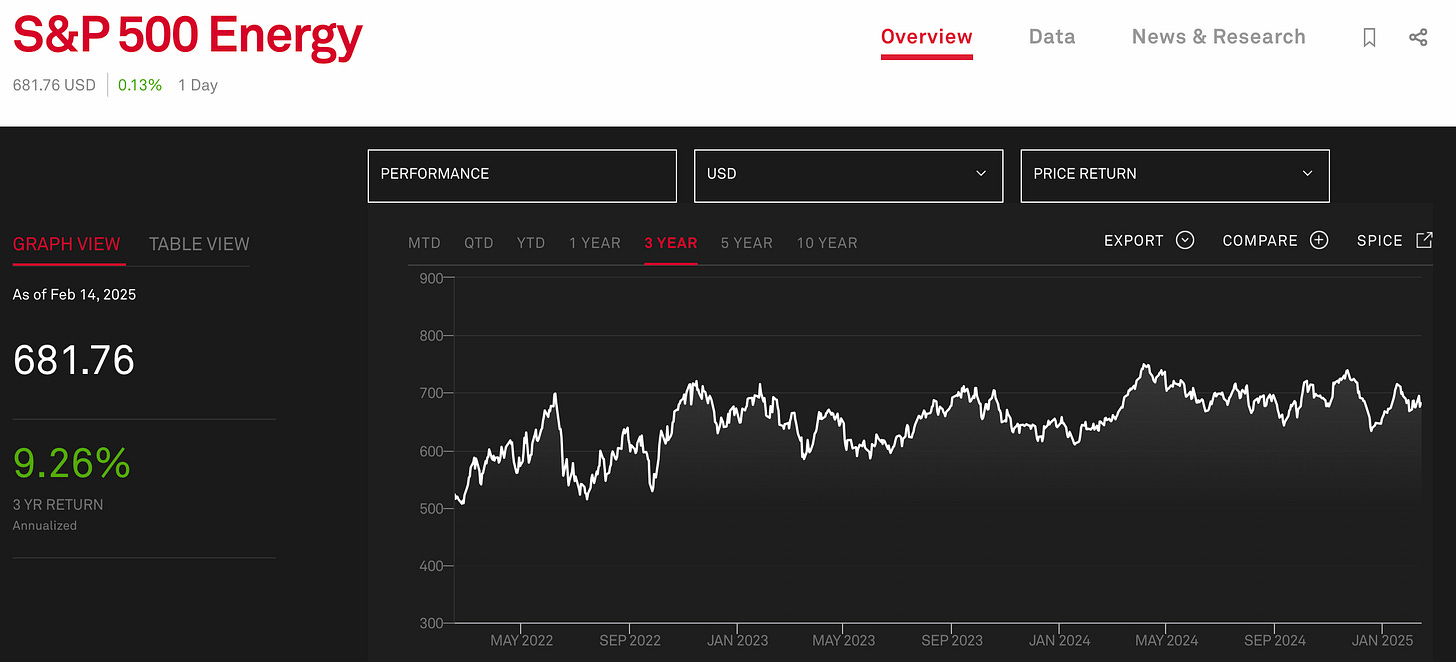

Currently, my target industries are Electrical Equipment and Machinery. I am using the S&P 500 Energy Index as a proxy for overall performance for these industries as they are closely related (the investments in ‘Machinery’ are really more pure-play energy enablement companies, so I’m grouping them into Energy for my purposes).

Because of the time-horizon of my investment goals, I pulled YTD, 1-Year, and 3-Year returns for the S&P500 Energy Index:

Now, returns are always relative, so you have to pull SPY (The market, as I consider it…) too:

SPDR S&P500 ETF TRUST (SPY) Returns (As of 2/15/2025):

YTD - 2.78%

1 Year - 26.23%

3 Year - 11.81%

Notably, Energy is lagging long-term but is actually up YTD.

For me, my read on this is that Energy is perhaps experiencing a bit of momentum coming in at the tail-end of the AI/Tech hype ending 2024 — this is exactly what I’m looking for.

D. Consumer Sentiment

Consumer Sentiment (CSI) is harder to quantify, but as I expressed in Part 1, my intuition tells me people are fairly confident long-term in the strength of our economy but are becoming a little bit more sporadic short-term.

The hallmark gauge for understanding consumer sentiment comes from the monthly University of Michigan Survey of Consumer Sentiment. The quote below is the official definition for this assessment.

“The University of Michigan Survey of Consumer Sentiment Index is an economic indicator which measures the degree of optimism that consumers feel about the overall state of the economy and their personal financial situation”

I pulled the latest available data for the gauge on CSI, and remarkably we are actually in a period of low consumer sentiment — people aren’t as optimistic as I’d hoped.

It is worth noting that this graph is as of 12/31/2024, but the latest data as of 2/13/2025 has indicated that the latest CSI score has remained unchanged at 74. My cup half full personality also points out that we are on an uptrend for this reading, so that’s hopeful 😃 .

E. Policy Risk

Another one that is sometimes harder to quantify what each event actually means for my particular investment thesis, I found the article below particularly helpful for understanding the broader picture of everything that is happening and provides the ability to dive deeper as needed into each individual event. It was started on 1/29/2025 is updated regularly.

For me, after reading through this list, there are two unique (i.e. not ever-present) main themes to watch that I think at this point everyone knows about: tariffs and DOGE.

Now, historically, each president has issued an average of 67 executive orders and Trump is already ~50, so it would be wise to suspect these types of changes will become more regular, but on the bright side, that creates volatility and that’s not a bad thing for a slower-moving industry like Energy.

Luckily, with additional regard to my particular investment industries, tariffs on alternate forms of energy and energy tech are unlikely while tariffs on existing forms of energy consumption (namely, imported oil) are highly likely — which will invariably lead to U.S. consumers to explore these alternative avenues of energy. On a similar note, counter-tariffs will also encourage other nations to go elsewhere for their energy needs. It’s a win-win for our purposes.

DOGE is another story entirely, but is on a similar wavelength to the general theme of creating waves and volatility in the markets. Plus, who can argue with a government agency tasked with reducing waste and increasing government efficiency?

My takes here may be a bit buy-side biased towards my investment opportunity targets, but that’s okay in my book — I intuitively was already targeting these areas because I thought this would be a tailwind.

Summary

In this piece, I considered the following factors as pieces in the broader macro environment that may affect my investment opportunities:

A. Interest Rates

B. Government Debt

C. Market & Industry Performance

D. Consumer Sentiment

E. Policy Risk

I did my best to go through each factor objectively and explain what it is and how it matters with every investment opportunity, and also touch a bit on how it might matter for my industry targets that will play host to my specific investment opportunities.

I’d love to hear from you on which macro-specific areas you are wary of when investing… what do you track? How do you track it?

The quote is one of my favorites when thinking about these dynamic features of our market.

“What gets measured gets managed”

I’m looking forward to getting more narrow in the next few parts of this series. This stuff is the groundwork and must be considered, but the next bits are like building the skyscraper on the foundations — it’s fun, exciting, and you can mold it how you like.

In learning,