[Business] Part 5: Separating the Best from the Rest

The next part in my Finding the Perfect Investment for 2025: Screening, Screening, and more Screening!

Hi Readers,

I’m delighted to bring the 5th part of my series, Finding the Perfect Investment for 2025.

In the past four parts, we’ve laid the important groundwork to start screening for individual investment opportunities confidently and gained crucial industry knowledge to help us sift through the multitude of different investment options.

In this analysis, I will be covering:

Part 5: Screening, Screening, & More Screening

[Part 6 Preview]: Trimming the Fat

Specifically, I will be walking you through how I screened for investment opportunities by meticulously applying relevant screening criteria related to growth, valuation, leverage, and other key factors.

By the end of the post, we will have ~50 legitimate investment opportunities to double-tap into in Part 6: Trimming the Fat.

1. Screening, Screening, & More Screening

First and foremost, it’s worth noting that the tool I will be doing my screening in is FinChat.io. I describe FinChat and why it’s a pure-play alpha generating tool in my post, I found the PERFECT investing stack so you don't have to...

To reiterate where we are jumping off from, remember that we’ve narrowed down our industry interests to the broader buckets of Energy & Utilities.

Context now shared, it’s time to get into the details.

The first thing I did when screening for companies was filtering by Energy & Utility related sub-sectors. For those not familiar, there are 11 GICS sectors generally accepted as appropriately classified. Energy and Utilities are two of them. Importantly, though, there are sub-sectors under each of these that companies are further classified into. I went through the list of available sub-sectors on FinChat and included them in my ‘Industries’ section.

Next, I went through and added only U.S. + Chinese based companies as well as U.S. based stock-exchanges (NYSE, NASDAQ, etc.). I know, we may be excluding some of the best international companies for these industries, but hang with me — we’ll cover them later (spoiler: they get added back in).

Then, I added Market Cap as a filter and set it to be larger than 10B. I only want “real” companies as opportunities, and this seemed to be the threshold for these industries. In addition, I added Forward P/E and TTM P/E to start getting a gauge for these numbers relating to our companies. Lastly, I added EBITDA and set it to be anything >0 to exclude companies that aren’t profitable.

After I ran the screener for just these industries, geographic locations & listings, and market cap, the number of companies that met the criteria was 246.

One thing I noticed after running this screener is that we were getting a ton of companies in the more niche sub sectors like ‘Electrical Equipment’ and ‘Electronic Equipment, Instruments, and Components’. Similar to with excluding companies based on region, I decided to exclude some key opportunities here with the intention of including them back in later, which remains what ensued.

I initially wanted a smaller list of companies to peruse, so I excluded these sub sectors to only include the core sectors in the image below:

Before running the screener for these industries, though, I decided to add in a few more key filters. These were primarily related to ensuring that the companies we were profiling had positive earnings on a longer term basis. I added 1Y, 3Y, and 5Y earnings CAGR and set them to be >0%.

After running the screener post adding the last couple of steps, there were only 131 companies remaining. Cull the herd.

Next, I wanted to get some forward looking sentiment in the mix. I added 1Y Forward CAGR, 2Y Forward CAGR, 3Y Forward CAGR, and 5Y Forward CAGR and set them to be >0%. This ensures that not only have the remaining companies profitable in the past 1-5 years, but are forecasted to continue to grow.

And, before running the screener once more, I added our beloved interest coverage ratio screener and set it to be >0. I don’t want our companies swimming in debt, and subsequently, interest payments. Interestingly, there were a handful of companies (Brookfield Asset Management BAM 0.00%↑ being a notable name) that were thrown out with this interest coverage filter… crazy!

Then I ran the screener again — 71 companies.

Next, I changed directions for a second. I added CAPEX growth metrics for 1Y, 3Y, and 5Y. This made sense to me at this point just to get another measure of the scale of these companies. Also, CAPEX can be another strong signal of stability and outlook — so accelerating or increasing CAPEX metrics, especially when evaluated as a trend, can shed light on overall company trajectory. Money is being put on the table, and that means something!

Okay, at this point, we had our companies and a lot of metrics to look at. Truthfully, it became a little bit overwhelming at the right moment — because the next part for me was all about cutting down on the number of prospects. We added so much to then start to remove even more, which usually is a good sign of thoroughness and understanding.

To start in this process, I read through the first 20 stocks sorted by market cap and quickly discovered the companies showing up categorized by “Electronic Equipment” weren’t relevant to my wider industry investing interests, so I removed these for now.

39 stocks remained.

Then, I added Total Return metrics (I know… I said I was done adding), only to be able to remove companies further by requiring their 1Y, 3Y, and 5Y Total Returns (CAGR) to be >0%.

23 stocks remained. Now we’re cooking with gas! ⛽️

At this point, I felt comfortable being able to read through companies and remove them manually as I saw fit. I knew the companies remaining were large, had their handle on debt, had positive earnings and returns, and positive future outlook.

Oh, and one more thing — at the very end, I added some additional valuation metrics to get a better picture of typical industry values. This might have been “overfitting” a bit, but it isn’t my main focus in assessment, so they’re just ancillary at this point. These were the following: PEG, P/B (to measure Price:Asset Value), and P/E (which is just another validating look @ EV/EBITDA).

This is where personal judgement comes into play based on industry knowledge and our investing goals (laid out in Parts 1-2). I read through each company and analyzed their business segment descriptions, researched segments not well understood further, and removed them.

I only ended up removing 2 more — our FINAL group was chiseled down to 22 companies from the big marble slab of companies we started with at the beginning (246).

Here was the final list: CHX, AEP, SO, WTTR, AES, FTI, NEE, AROC, XCEL, ARIS, BKR, NGS, ORA, FET, NOV, SLB, HLX, VST, ETR, TTI, OTTR, USAC

As mentioned, we did exclude quite a few companies based on industry that I want in our final final list.

In short, I removed the existing industries and replaced them with the ones we removed — and kept our filters — to yield the following additional list of companies:

SIEGY, ITRI, EMR, AME, HUBB, PSIX, POWL, SEI, ENERSYS, ENS, AEIS

Similarly, I provided our list to ChatGPT and prompted it with:

“I’m screening companies in the Energy industry for an investment opportunity. After doing an initial screening, here is my list of companies [inserted company list]. Please share any additional companies that should be on my radar related to these companies that are compelling investment opportunities”

ChatGPT then gave me the following list:

CATL, EVE, Gotion, EOS, EPH, FLS, WLDN, ICFI, TTEK

Lastly, because of the amount of reading and listening I did, I had some companies on my personal agenda to review and look at. These were intuitive and largely based off of expert sentiment expressed in my resources. I had been adding these to my Robinhood list throughout this process. Not all made the my final screener, and the image below isn’t exhaustive by any means.

After ALL of this screening, I decided to take each company, add it to a FinChat dashboard (different than screener) to be able to measure and manage each company. It was largely the same as my screener, but from here I exported the list to Google Sheets to be able to do further analysis.

There ended up being 72 companies on this list!

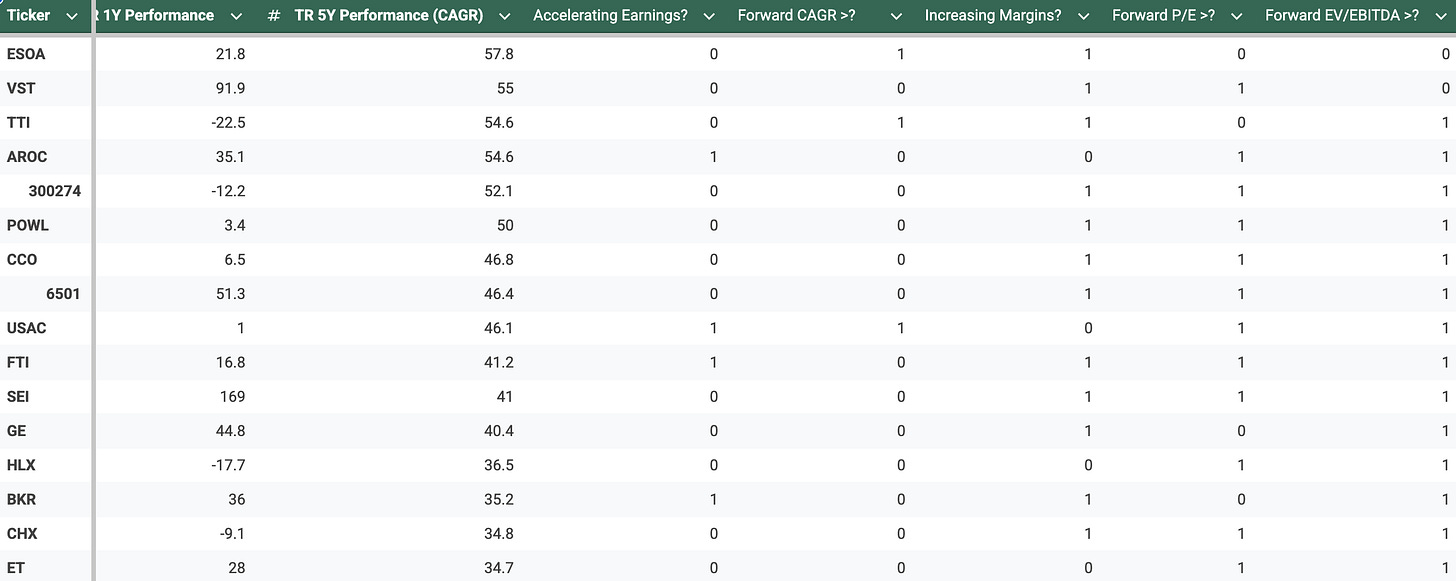

After adding some key custom metrics like Increasing Earnings, Increasing Forward CAGR, Increasing Margins, and Forward Valuations > TTM (P/E + EV/EBITDA), I was able to filter the list down even further. How awesome!

Now, drum roll…

After screening for companies that ALSO met my custom metrics above, there was only ONE that met all of the custom metrics, and only around a dozen of companies that met a combination of 1-2 of the custom metrics.

And that wraps up the initial screening! Phew… that was easy! 😉

Wondering what our golden company? The others? I can tell you they’re truly solid.

For the reveal, we’re going to play a game: comment 💬 the company you think is our golden company or companies you think made the final dozen correctly, and I’ll DM you the Google Sheet they are currently living in.

This list won’t be released to Readers of amalgamation until Part 6, which could be 1-3 weeks out, so you won’t want to miss out on having early access amid this fruitful Energy market.

Take your investing a step further, engage with the amalgamation community, and get your hands on the list early!

I hope you learned a thing or five about how to effectively screen for companies. Use tools, keep your investing goals front of mind, and leave as much emotion out of it as you can. Numbers don’t lie.

I’m excited to “Trim the Fat” in the Part 6 of this series. More details to come.

AND, make sure to get your paws on the Google Sheets list to follow along going forward by participating as outlined in our “game” above ⬆️

Share your thoughts with amalgamation community, be a contributor, and grow with us.

In Learning,

Disclaimer: No Financial Advice Provided

The content on this Substack, including articles, insights, and opinions, is for informational and educational purposes only and should not be considered financial, investment, tax, or legal advice.

I am not a licensed financial advisor, broker, or investment professional.

Any decisions you make based on this content are at your own risk.

Always consult with a qualified financial professional before making investment decisions.

This Substack does not offer personalized financial advice or recommendations.

By reading this content, you acknowledge and agree that the author is not responsible for any financial decisions made based on the information provided.