I found the PERFECT investing stack so you don't have to...

After FOUR months of attempting to find my personal investing stack that would provide me the clearest insights and ability to monitor and manage - I've finally found the best of the best.

Readers,

I’m excited to share my personal investing stack with you today. After over four months of sifting and searching to find the perfect tools and resources to generate consistent weekly, monthly, and yearly gains, I’ve finally formulated the magic sauce:

1. For Investing: Robinhood

2. For Crypto Trading: UniSwap

3. For Monitoring: TradingView

4. For Investing News: BrewMarkets, Substack, & TL;DR

5. For Crypto News: CoinDesk & Bankless

6. For Insights (AI): Danelin & FinChat

Read into each of these sections below. I will provide a brief overview of each tool/resource and links to try them out yourself (I’m not popular enough to be affiliated… 😁).

(P.S. #6 is my favorite!)

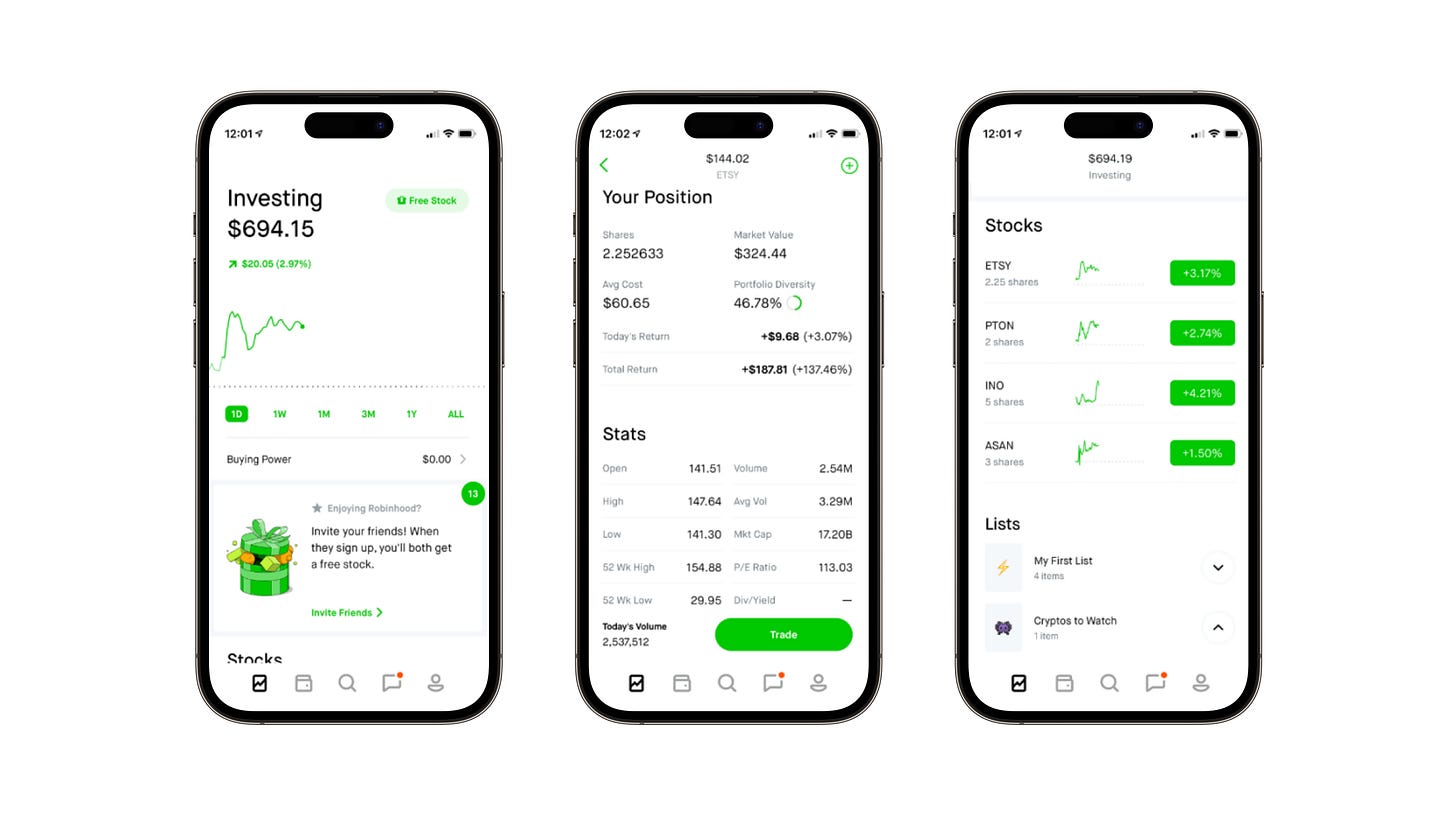

1. For Investing: Robinhood ✊

Robinhood is a well known platform in the investing space, but it blows my mind every time I meet someone over 30 years old who hasn’t heard of it. They’re missing out.

I’ve been using Robinhood since I became an investor, and there is no better platform for onboarding, on-ramping, and getting your investments placed quickly. On top of this, it offers more seasoned investors a seamless user interface to track and manage assets while providing opportunities for deeper-insights at the click of a button.

Robinhood prides itself on it’s slick design, and is continuing to improve its offerings as seen with its recent move in offering a 3% match IRA and integrated crypto wallet all in-app.

(Not my investments)

If you’re not using Robinhood, you’re spending too much time investing without direction and clarity.

Don’t feel obliged, but sign up for a Robinhood account using my link if you want to help a friend out: Create Robinhood Account Today

2. For Crypto Trading: UniSwap 🗣

For those who are new to the crypto space, finding a wallet can be a daunting task — even learning what a wallet IS can be a daunting task.

Uniswap is a decentralized exchange — an exchange not operated by a single company or organization — that provides the ability for investors to quickly buy each and every crypto token they want (centralized exchanges can limit investment options).

Uniswap has a slick browser extension, app, and is continuing to invest in the amount and types of integrations with other platforms. If you’re not as savvy, you might benefit by first using a centralized exchange — Coinbase or Robinhood — but UniSwap is my favorite.

(P.S. If you’re using a centralized exchange for trading already, consider switching!)

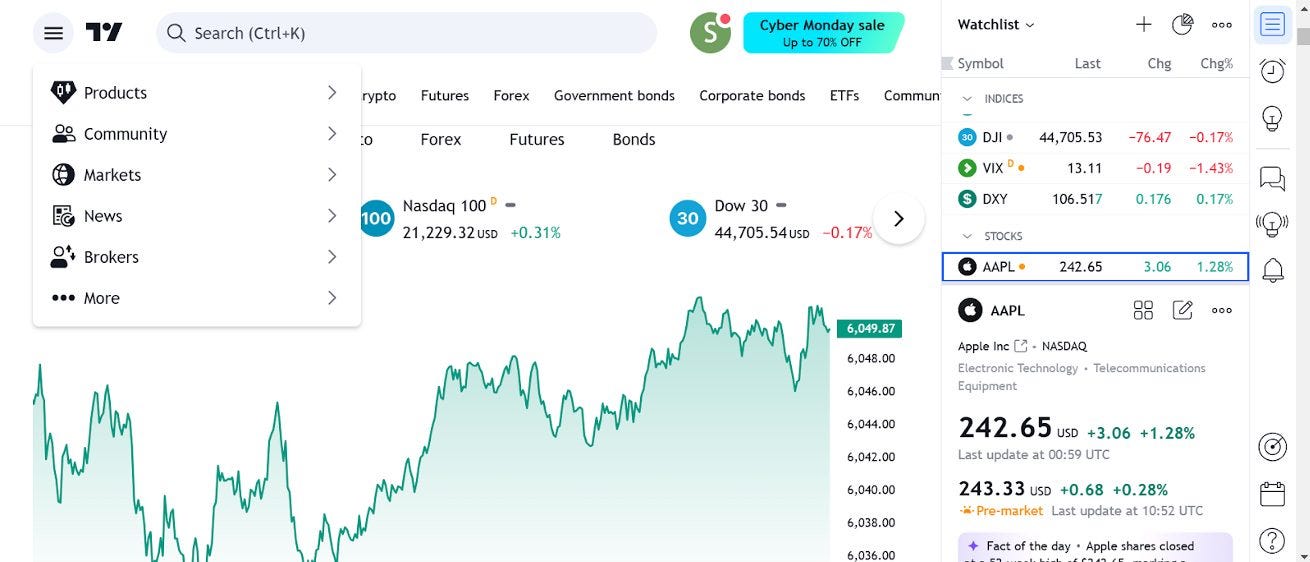

3. For Monitoring: TradingView 💻

TradingView is a tool that I’ve come across more recently to improve my monitoring and tracking of investments on a more detailed level.

TradingView allows you to build complex dashboards, portfolios, and other views with an easy drag-and-drop format. I’ve never been able to get up and going with a custom dashboard so easily.

I’m currently soaking up every capability I can from the free version, but if you have money to spend — consider unlocking more.

(Not my investments)

4. For Investing News: BrewMarkets, Substack, & TL;DR 📈

Because these three resources are too good to not mention all of them, I’ve taken the time to touch on each 😀.

BrewMarkets is a free newsletter from ‘MorningBrew’. Being an off-shoot of MorningBrew, BrewMarkets focuses on a daily roundup of market performance, market news, market trends, and upcoming events. The newsletter is simple, easy to read, and gives me a great 2-minute look at the markets telling me everything I needed to know about that day and the day ahead.

Sign up with my BrewMarkets code here (it’s free): BrewMarkets

Substack is another resource I’m recommending today. You might be whining, “Chris, we’re already on Substack — we know it’s solid”, but I stay firm in my conviction that Substack offers alpha.

For me, the true value of Substack came when I started deliberately following authors closely. I began by subscribing to a couple handfuls of the most popular creators and whittling them down little by little until I was left with what I have now: 5-6 creators that provide me with a bit more detail on the market news I care about (i.e. opening bell news, trends, performance, closing bell news, a look ahead at the week & month).

Here are a few of my favorite Substack newsletters for insights:

, ,Lastly, I would be remiss if I didn’t mention TL;DR. It is the quickest way to get a slew of potential reads to get your day started and learn more quickly. Make sure to check out all of their newsletters: Crypto, AI, and Product.

Sign up to receive the newsletters with my referral code.

5. For Crypto News: CoinDesk & Bankless 👾

For Crypto news I want resources that are quick to the punch and explain things in layman’s terms.

No two sources do this better than CoinDesk and Bankless.

For bonus content, check out the Bankless podcast.

I use both sources for quick-hit content and updates and often save articles from their newsletters for later to take deep dives.

I suggest you do the same.

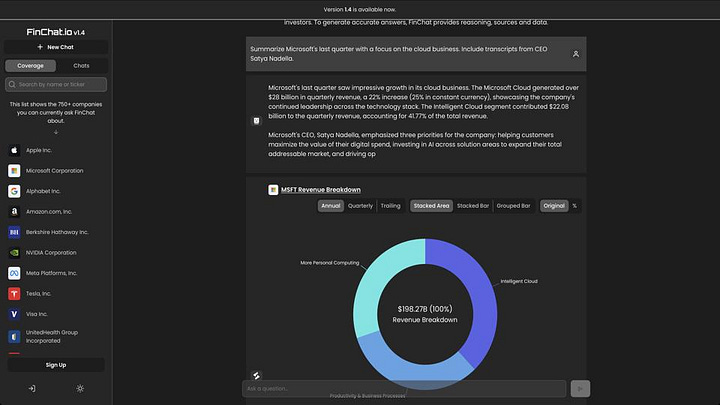

6. For Insights: Danelfin & FinChat 🤖

Before writing this piece, I knew this would be my favorite section.

As a fan of AI in certain verticals, I’ve found tons of value in using AI for finance and investing. While the predictive capabilities of AI investing tools needs a bit of work, having a starting point to go off of for new investment ideas and synthesizing market data + trends quickly and effectively is an extremely effective way to create your own theses.

Two of the best tools for this are Danelfin and FinChat.

Danelfin is a complete AI-powered tool that tracks everything going on in the market. I use this tool to give me a daily overview of how 10 stocks that I’m watching closely are performing from an AI-perspective. The tool takes into account fundamentals, technicals, and market sentiment and gives investments an ‘AI Score’ and likely return over different time intervals given the current combination of the factors above. In addition, I have a newsletter from Danelfin that tells me the ‘Top 10’ Stocks + ETFs both in the United States and abroad for the week day. Given this list, I often double-tap into the continuously updated lists for new investment ideas. Make sure you look into how Danelfin works to understand how to truly leverage it. Because of Danelfin, I’m never a step behind.

FinChat is AI-Powered, but in a different light. FinChat is a tool that allows you to maneuver through financial data in different ways: create catered lists through filtered financial data criteria, monitor pre-built lists, converse with an AI-assistant in an LLM-format (e.g. “Give me a list of the 50 top stocks over 10B in market cap sorted by their 5 year CAGR EPS growth-rate”), and more. I’ve been using FinChat’s dashboard capabilities to monitor the performance of a hypothetical basket of stocks that I’m interested in investing in. I also used it to screen for a couple of my top performing equities in 2024. Get familiar with FinChat and find how you can use it for your specific needs.

Summary

If you’ve made it this far, go and try out the tools I’ve given you above. Find how they might work for you.

Developing a personal stack of tools and resources to fall back on is essential for accomplishing your goals throughout the year. Label this stack and call it yours.

Let me know how you use the tools and resources above to your advantage — I have more where these came from.

Until next time,